net investment income tax 2021 trusts

As a result any net investment income generated by the trust is included in the grantors net investment income potentially subject to the 38 tax at the individual level. Overview Data and Policy Options Since 2013 certain higher-income individuals have been subject to a 38 unearned income.

Irs Form 8960 Fill Out Printable Pdf Forms Online

The Net Investment Income Tax does not apply to any amount of gain that is excluded from gross income for regular income tax purposes 250000 for single filers and.

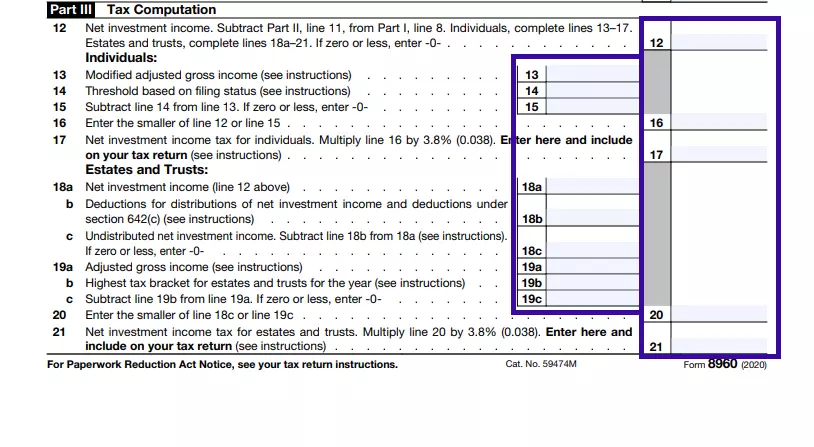

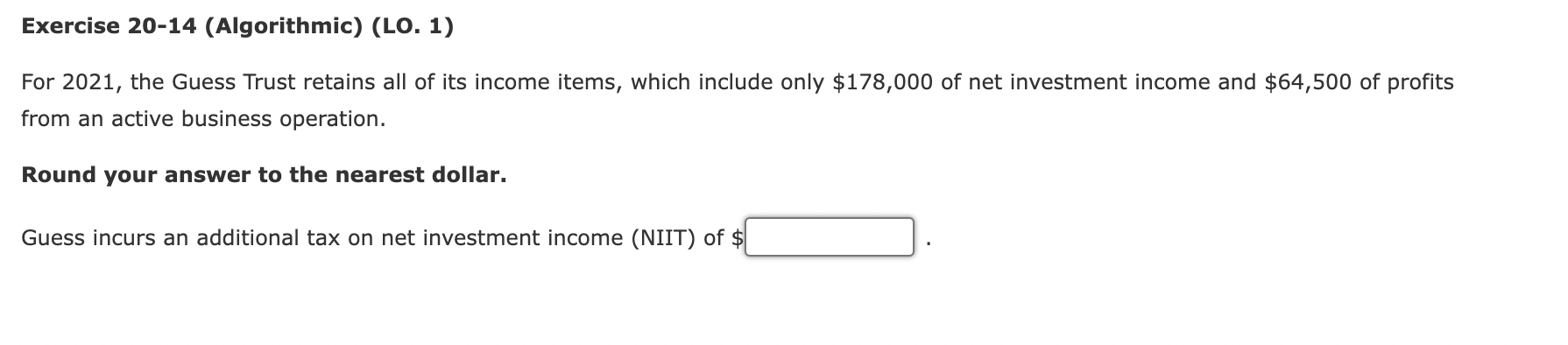

. The estates or trusts portion of net investment income tax is calculated on Form. Retained in the trust will be subject to the high trust tax rates including the 38 tax on trust net investment income that applies above the MAGI threshold only 13050 for 2021. The net investment income tax is equal to 38 of the lesser of the taxpayers 1 net investment income for the tax year or 2 the excess if any of the MAGI for the tax year.

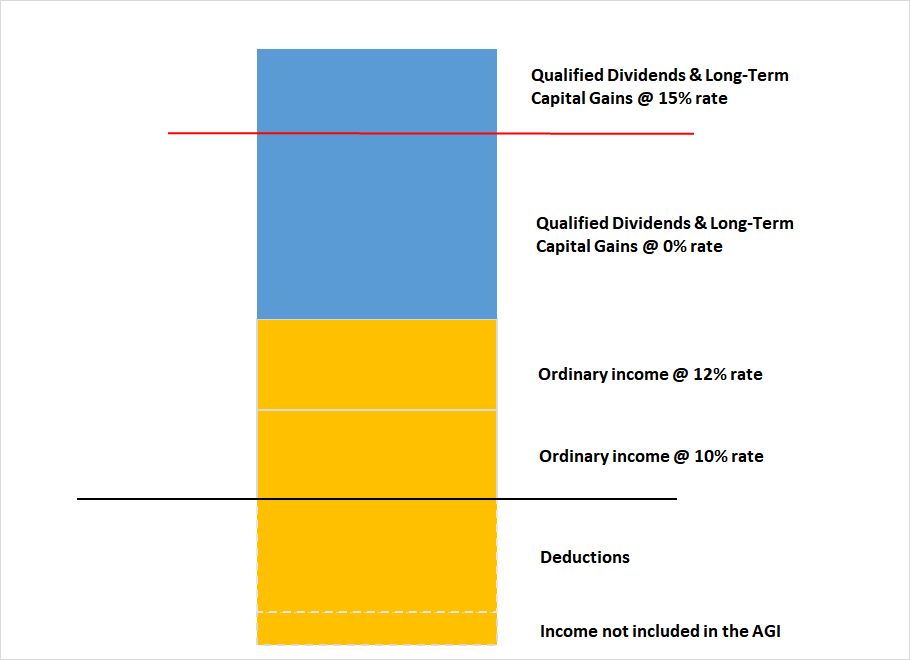

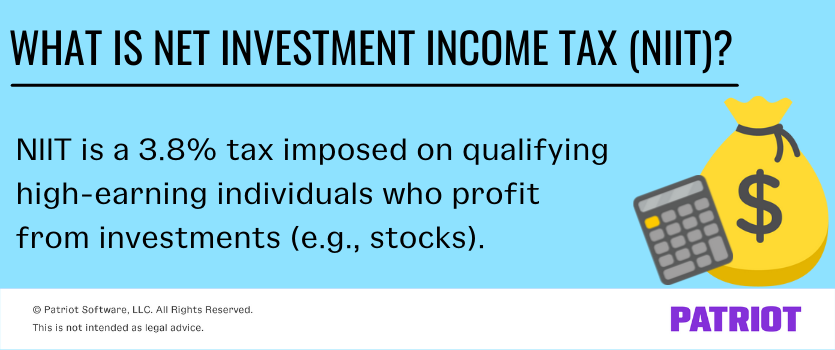

Generally net investment income includes gross income from interest dividends annuities and royalties. Effective January 1 2013 Code Sec. 2022-08-08 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of.

1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted. Net investment income NII is income received from investment assets before taxes such as bonds stocks mutual funds loans and other investments less related. 1411 imposes the 38-percent Net Investment Income Tax NIIT on the net investment income of individuals trusts and estates.

The net investment income tax is a 38 tax on investment income that typically applies only to high-income taxpayers. 2021 Georgia Code Title 48 - Revenue and Taxation Chapter 7 - Income Taxes Article 2 - Imposition Rate Computation Exemptions and. Justia Free Databases of US Laws Codes Statutes.

1 It applies to individuals families estates and trusts. April 28 2021 The 38 Net Investment Income Tax.

Is A Section 1231 Gain Subject To Net Income Investment Tax Niit

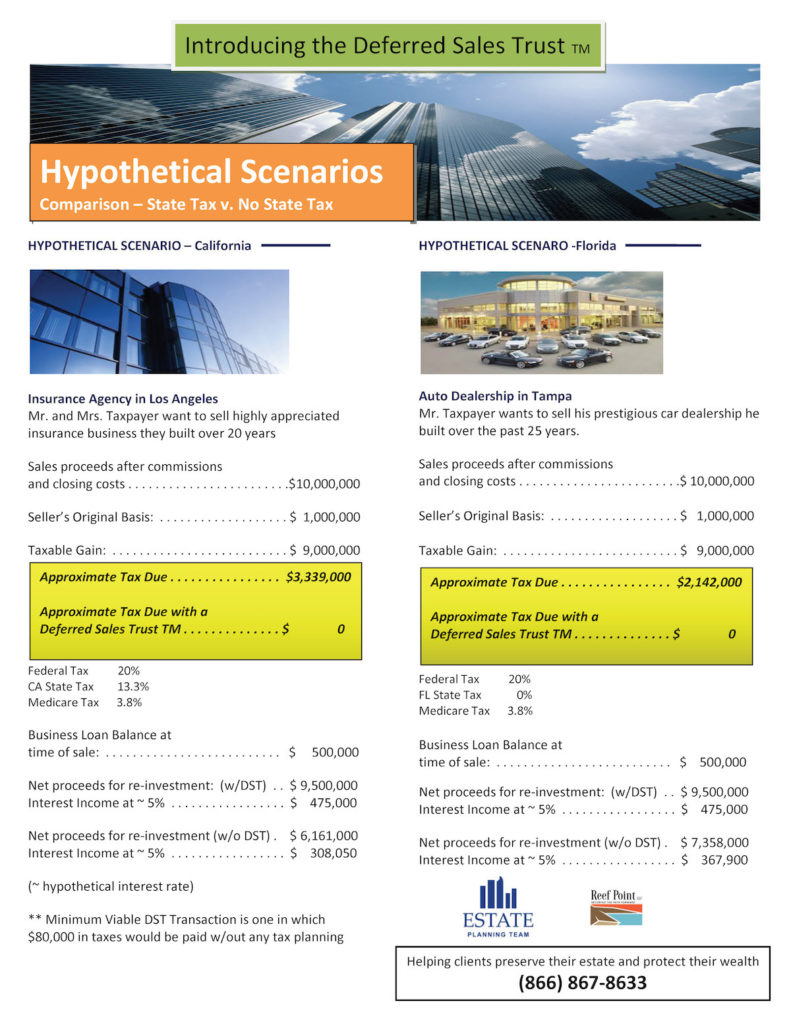

Attorneys And Deferred Sales Trust Reef Point Llc

Solved Exercise 20 14 Algorithmic Lo 1 For 2021 The Chegg Com

2022 2023 Tax Brackets Standard Deduction 0 Capital Gains Etc

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

What Is Net Investment Income Tax Overview Of The 3 8 Tax

Investment Expenses What S Tax Deductible Charles Schwab

Solved You Are Working As An Accountant At A Mid Size Cpa Firm One Of Your Clients Is Bob Jones Bob S Personal Information Is As Follows October Course Hero

Tax Treatment Of Outright Gifts To Charity 2021 Cambridge Trust

Income Taxation Of Trusts And Estates After Tax Reform

Tax Benefits And Implications For Reit Investors Realaccess Issue No 4 Nuveen

Net Investment Income Tax Niit Quick Guides Asena Advisors

Here Are Some Savvy Tax Efficient Investment Strategies

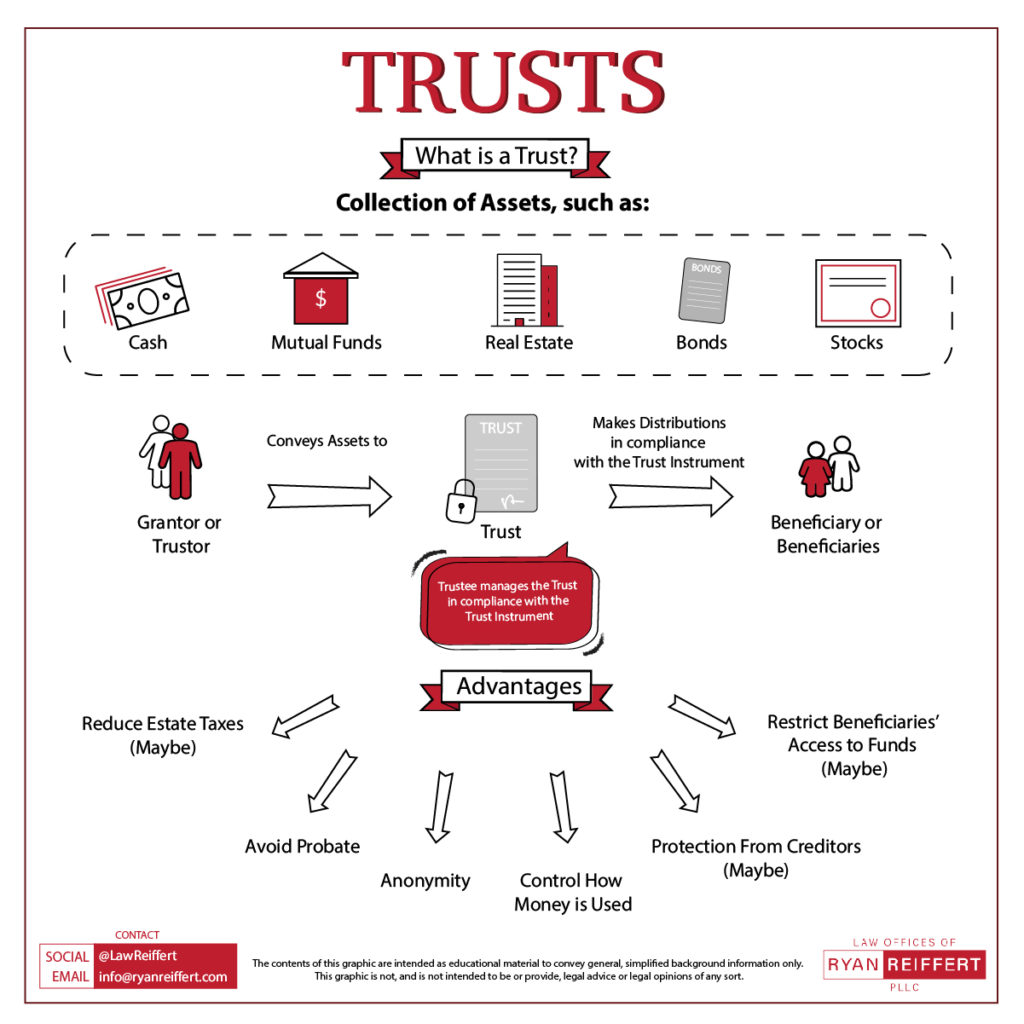

Trusts 101 How Many Types Of Trusts Are There Ryan Reiffert Pllc

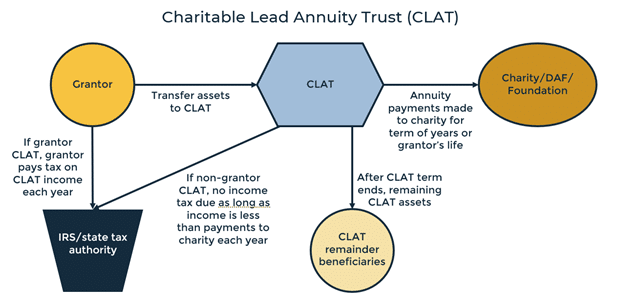

Charitable Lead Annuity Trusts Clats Wealthspire Advisors

Assault On Family Businesses Continues The S Corporation Association

Irrevocable Trusts What Beneficiaries Need To Know To Optimize Their Resources J P Morgan Private Bank